I want to begin by wishing my personal best to everyone—for you and your families’ health and safety during these difficult times.

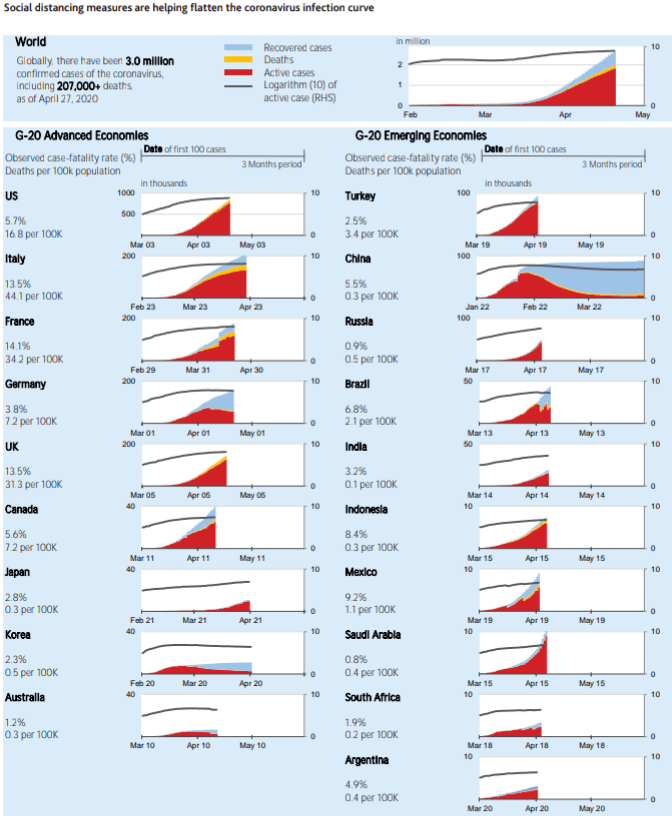

Today we are confronted with a crisis like no other. Covid-19 has disrupted our social and economic order at lightning speed and on a scale that we have not seen in living memory. The virus is causing tragic loss of life, and the lockdown needed to fight it has affected billions of people. What was normal just a few weeks—going to school, going to work, being with family and friends—is now a huge risk.

I have no doubt that we will overcome this challenge. Our doctors and nurses are fighting it around the clock, often risking their lives to save the lives of others. Our scientists will come up with solutions to break COVID-19’s grip. Between now and then, we must marshal the determination of all—individuals, governments, businesses, community leaders, international organizations—to act decisively and act together, to protect lives and livelihoods.

The actions we take now will determine the speed and strength of our recovery. That will be the focus of the major world agencies like IMF and World Bank in the coming days.

Where We Stand: the Status of the Global Economy

First, let’s look at where we stand. We are still faced with extraordinary uncertainty about the depth and duration of this crisis.

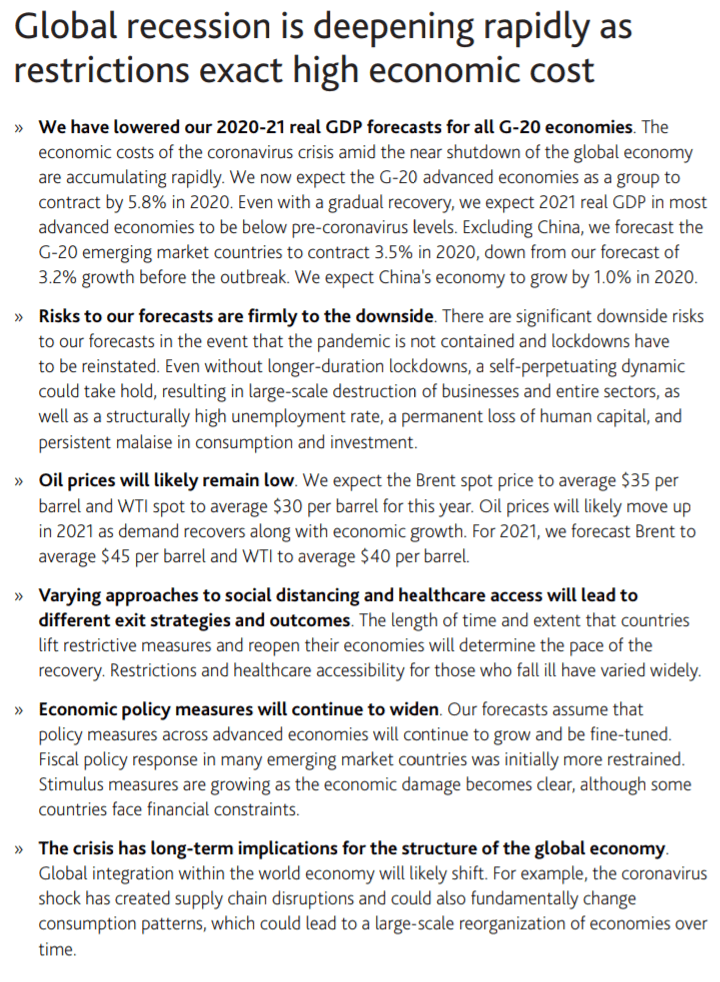

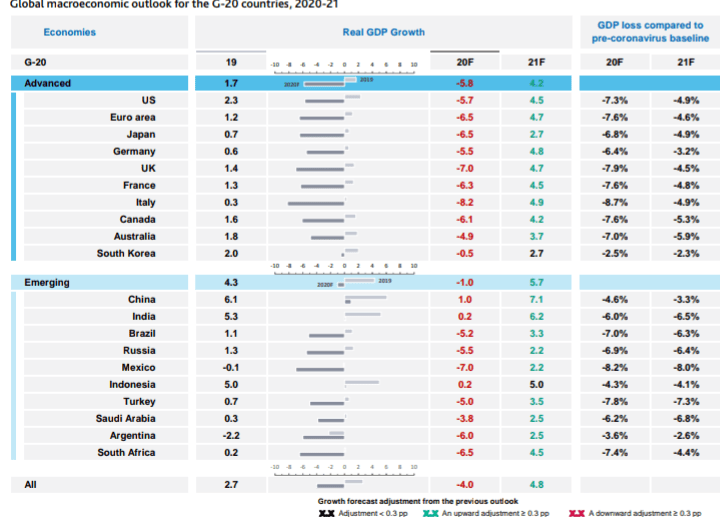

It is already clear, however, that global growth will turn sharply negative in 2020. In fact, I anticipate the worst economic fallout since the Great Depression.

Just three months ago, I expected positive per capita income growth in over 160 countries in 2020. Today, that number has been turned on its head: I now project that over 170 countries will experience negative per capita income growth this year.

The bleak outlook applies to advanced and developing economies alike. This crisis knows no boundaries. Everybody hurts.

Given the necessary containment measures to slow the spread of the virus, the world economy is taking a substantial hit. This is especially true for retail, hospitality, transport, and tourism. In most countries, the majority of workers are either self-employed or employed by small and medium-sized enterprises. These businesses and workers are especially exposed.

And just as the health crisis hits vulnerable people hardest, the economic crisis is expected to hit vulnerable countries hardest.

Emerging markets and low-income nations—across Africa, Latin America, and much of Asia—are at high risk. With weaker health systems to begin with, many face the dreadful challenge of fighting the virus in densely populated cities and poverty-stricken slums—where social distancing is hardly an option. With fewer resources to begin with, they are dangerously exposed to the ongoing demand and supply shocks, drastic tightening in financial conditions, and some may face an unsustainable debt burden.

They are also exposed to massive external pressure.

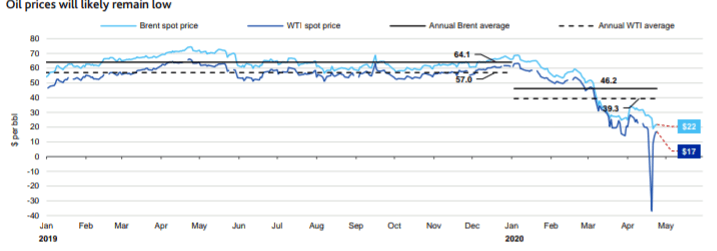

In the last two months, portfolio outflows from emerging markets were about $100 billion—more than three times larger than for the same period of the global financial crisis. Commodity exporters are taking a double blow from the collapse in commodity prices. And remittances—the lifeblood of so many poor people—are expected to dwindle.

I estimate the gross external financing needs for emerging market and developing countries to be in the trillions of dollars, and they can cover only a portion of that on their own, leaving residual gaps in the hundreds of billions of dollars. They urgently need help.

The encouraging news is that all governments have sprung into action and, indeed, there has been significant coordination. Countries around the world have taken fiscal actions amounting to about $8 trillion already. In addition, there have been massive monetary measures from the G20 and others.

Many of the poorer nations are also taking bold fiscal and monetary action, even as they grapple with this fundamental shock to their systems—and with far less firepower than their rich-country counterparts.

So this is a snapshot of where the global economy stands today.

There is no question that 2020 will be exceptionally difficult. If the pandemic fades in the second half of the year—thus allowing a gradual lifting of containment measures and reopening of the economy—my baseline assumption is for a partial recovery in 2021. But again, I stress there is tremendous uncertainty around the outlook: it could get worse depending on many variable factors, including the duration of the pandemic.

And crucially, everything depends on the policy actions taken now.

What Needs to be Done: a 4-Point Plan

My next point is about building the bridge to recovery. We see four priorities:

First, continue with essential containment measures and support for health systems. Some say there is a trade-off between saving lives and saving livelihoods. I say it is a false dilemma. Given this is a pandemic crisis, defeating the virus and defending people’s health are necessary for economic recovery. So the message is clear: prioritize health spending for testing and medical equipment; pay doctors and nurses; make sure hospitals and makeshift clinics can function. For many countries—particularly in the emerging and developing world—this means carefully reallocating limited public resources. It also means increasing the flow of resources to these countries. That includes the flow of vital goods: we must minimize disruptions to supply chains and, with immediate effect, refrain from export controls on medical supplies and food.

Second, shield affected people and firms with large, timely, targeted fiscal and financial sector measures. This varies according to country circumstances, but it includes tax deferrals, wage subsidies and cash transfers to the most vulnerable; extending unemployment insurance and social assistance; and temporarily adjusting credit guarantees and loan terms. Some of these measures have been taken in the first wave of policy support. Many countries are already working on a second wave. Lifelines for households and businesses are imperative. We need to prevent liquidity pressures from turning into solvency problems and avoid a scarring of the economy that would make the recovery so much more difficult.

Third, reduce stress to the financial system and avoid contagion. Banks in Developed countries have built up more capital and liquidity over the past decade, and their resilience will be tested in this rapidly changing environment. The financial system is facing significant pressures, and monetary stimulus and liquidity facilities play an indispensable role. Interest rates have been lowered in many countries. Major central banks have activated swap lines and created new ones to reduce financial market stress. Enhancing liquidity for a broader range of emerging economies would provide further relief. Importantly, it would also lift confidence.

Fourth, even as we move through this containment phase, we must plan for recovery. Again, we must minimize the potential scarring effects of the crisis through policy action now. This requires careful consideration of when to gradually ease restrictions, based on clear evidence that the epidemic is retreating. As measures to stabilize the economy take hold and business starts to normalize, we will need to move swiftly to boost demand. Coordinated fiscal stimulus will be essential. Where inflation remains low and well-anchored, monetary policy should remain accommodative. Those with greater resources and policy space will need to do more; others, with limited resources will need more support.

This leads me to the role of the World Agencies like IMF and World Bank.

These agencies are working 24/7 to support countries—with policy advice, technical assistance and financial resources:

— These agencies have $1 trillion in lending capacity and are placing it at the service of all countries.

— IMF and World Bank are responding to an unprecedented number of calls for emergency financing—from over 90 countries so far. Access to emergency facilities has been doubled, which will allow the agencies to meet the expected demand of about $100 billion in financing. Lending programs have already been approved at record speed—including for the Kyrgyz Republic, Rwanda, Madagascar, and Togo—with many more to come.

— Their research teams are reviewing the available tool kits to see how they might better use precautionary credit lines to encourage additional liquidity support, establish a short-term liquidity line, and help meet countries’ financing needs via other options—including the use of SDRs.

— They have revamped their Catastrophe Containment and Relief Trust to provide immediate debt relief to low-income countries affected by the crisis, thereby creating space for spending on urgent health needs rather than debt repayment. They are now working with donors to increase the CCRT to $1.4 billion to extend the duration of the debt relief.

Conclusion: A Test of Our Humanity

Let me conclude with a line from Victor Hugo who once said: “Great perils have this beauty, that they bring to light the fraternity of strangers”.

It is this common threat that brings us all together, to harness the greatest strengths of our humanity—solidarity, courage, creativity, and compassion. We don’t know yet how our economies and way of life will change, but we do know we will come out of this crisis more resilient.

Thank you very much